Transformation for Dark Stores and Micro-Fulfilment

23.07.2024

Introduction

Much is being written about how the future of retail is being shaped by AI and changed consumer behavior. New digital technologies enable channel conversion, ensuring a consistent shopping experience and seamless switch of platforms to the consumer. Online customers are already used to full price transparency, endless virtual aisles, and a variety of delivery service options that traditional e-com provides.

Services that traditionally were sought after at brick & mortar stores, such as sales consultants and product experimentation, have long been replaced by reviews, chat bots and other digital support resources. More recently, influencers of social commerce have brought the fun of spontaneous shopping sprees into the universe of online shopping.

One stronghold, however, of traditional in-store shopping has been the grocery store, at least until the pandemic temporarily transformed many of them into “dark stores”.

While pandemic restrictions are now a thing of the past, curb-side pick-up is alive and well - and retailers can’t afford to not offer this service. Consumers who never knew they needed this option are now expecting full flexibility to order online and choose between getting it delivered to their doorstep within hours or make an appointment to pick up the readily packed groceries without having to go through the aisles by themselves.

The trend seems to be clear: Just as e-commerce distribution centers replaced traditional department stores in the mid-nineties, the days of grocery stores are now counted. Sooner rather than later they too will be replaced. Not by big distribution centers, though. For the sake of freshness and fast delivery to the consumers, smaller facilities near every residential neighborhood are required. This is where so-called micro fulfillment centers come into play, which will be highly automated to minimize footprints and operate cost efficiently.

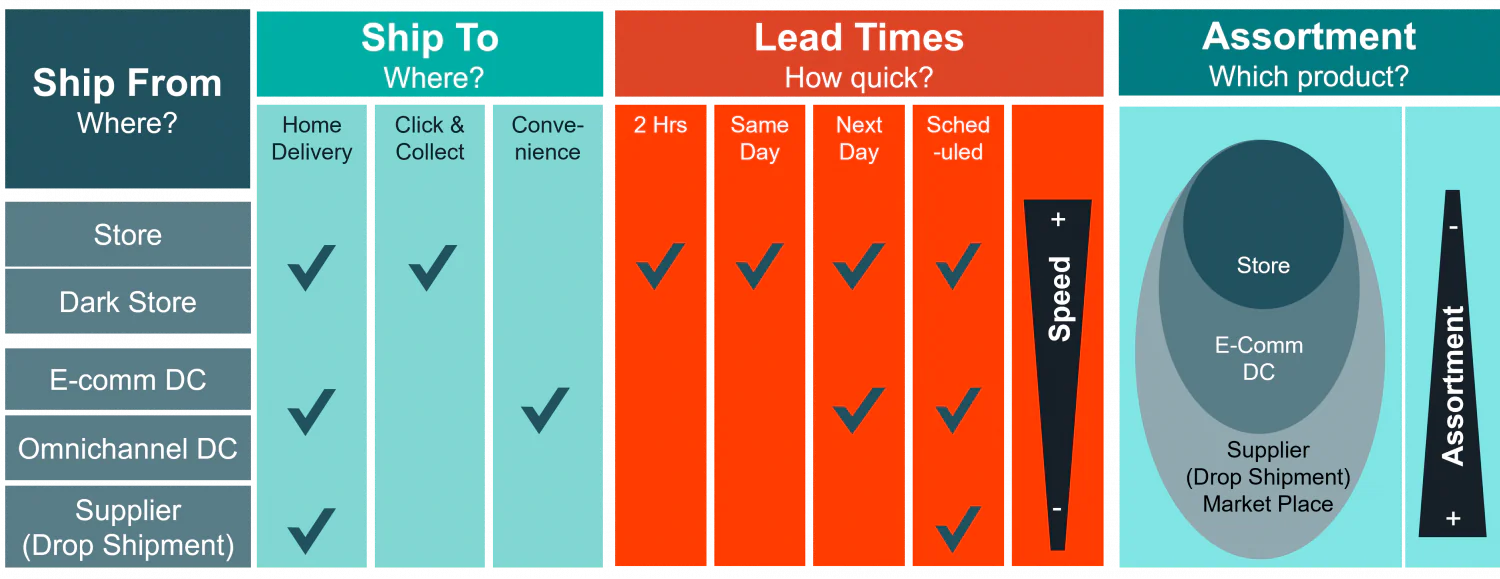

Fig. 1 Overview of retail fulfillment options

Cutting through the confusion: MFCs vs. Dark Stores

Funnily, when it comes to categorizing facilities that will shape the future of retail, a certain disconnect between aspiration and reality has made its way into the commonly used terminology.

“Dark stores” are being used for converted brick & mortar stores that don’t receive any walk-in customers, but instead prepare online orders for pick-up or delivery. Yet, in most of the cases the lights are not out in these facilities. The space for online fulfillment is either being shared with the still existing retail sales floor, or technology and processes are fairly conventional with fulfillment staff collecting orders just as a shopper would do with his shopping cart. Reasons for the apparent technology gap range from unplanned or even improvised conversions to building constraints that don’t make for a good fit of automated equipment.

On the other hand, the term MFC, or Micro Fulfillment Center, is used for a purpose-designed facility and almost always in the context of automation.

While automation is certainly an effective tool to achieve cost efficient handling and space efficiency in expensive urban areas, it is important to remember that today's consumer is hybrid:

There is no pre-defined preference for lowest price over fastest service or best convenience, nor the other way around. Rather than that the consumer expects options to choose from according to their needs in each situation.

With that in mind, the first and foremost question that retailers need to solve is the portfolio of shopping experiences they want to offer. Next, technology and location must be matched to fulfill that promise.

Shopping experiences with impact

Many consumers have a big concern about online shopping for fruits and vegetables. The specific point of ripeness of a banana is a very personal preference. Understanding this preference and choosing the perfect match for each customer is probably something machines can learn over time. Meanwhile a liberal returns policy could keep customers happy if they have the patience.

Giving consumers the option to shop for fresh produce in-store still seems to be the more obvious solution. While they take their time selecting fruit and vegetables, robots can pick packaged staples from the backroom and have it ready for the customer to consolidate their basket on the way out.

Testing the touch & feel of apparel is only one example where walk-in stores or showrooms are still required, at least until these sensory experiences can be transmitted to our brains by digital means.

A targeted in-store range of products, complemented by full-assortment fulfilment, also allows retailers to get customers to purchase additional items in a more subtle and persuasive way. It’s unlikely someone would be annoyed by nicely presented fresh items in a deli or bakery section, than by promotions blocking random aisles that you would rather rush through to get done with your shopping list.

Overall, it looks like a hybrid store with both self service and automated fulfillment provides the best match to consumer needs.

Urban Logistics that delivers

Last mile transportation is often the biggest portion of the total cost of order fulfillment. The fast delivery expected by the customers requires these facilities to cover a small geographical area. That limits the number of customers served by a single facility and thereby also the density of stops a delivery driver can make on a single trip.

At the same time, a small facility restricts the number of products that can be offered. Not only due to the limited storage capacity, but more importantly because only a small set of products will have a predictable demand in a small geographical area. To offer an assortment similar to a traditional hypemarket or big box store, typically more than 30,000 items, the area covered needs to be large enough to level out volatile demand of slow-moving items. Delivering from such facilities, however, would lead to long delivery times and high transport costs, contradicting what was the objective in the first place.

With existing commercial properties spread out in urban zones consumers pass by them on their way to work or other daily errands. If stopping by and picking up is a no-hassle experience, or perhaps a wait can be combined with an inspiring showroom visit, a work-out at the gym next door, or a trip to the movies, etc. then delivery is not needed, benefitting the customers pocket and the environment.

In summary, hybrid locations that offer both in-store experience and pick-up ready order preparation satisfy more costumer needs. They can offer a wider range of products and services and still be cost-effective and sustainable at the same time.

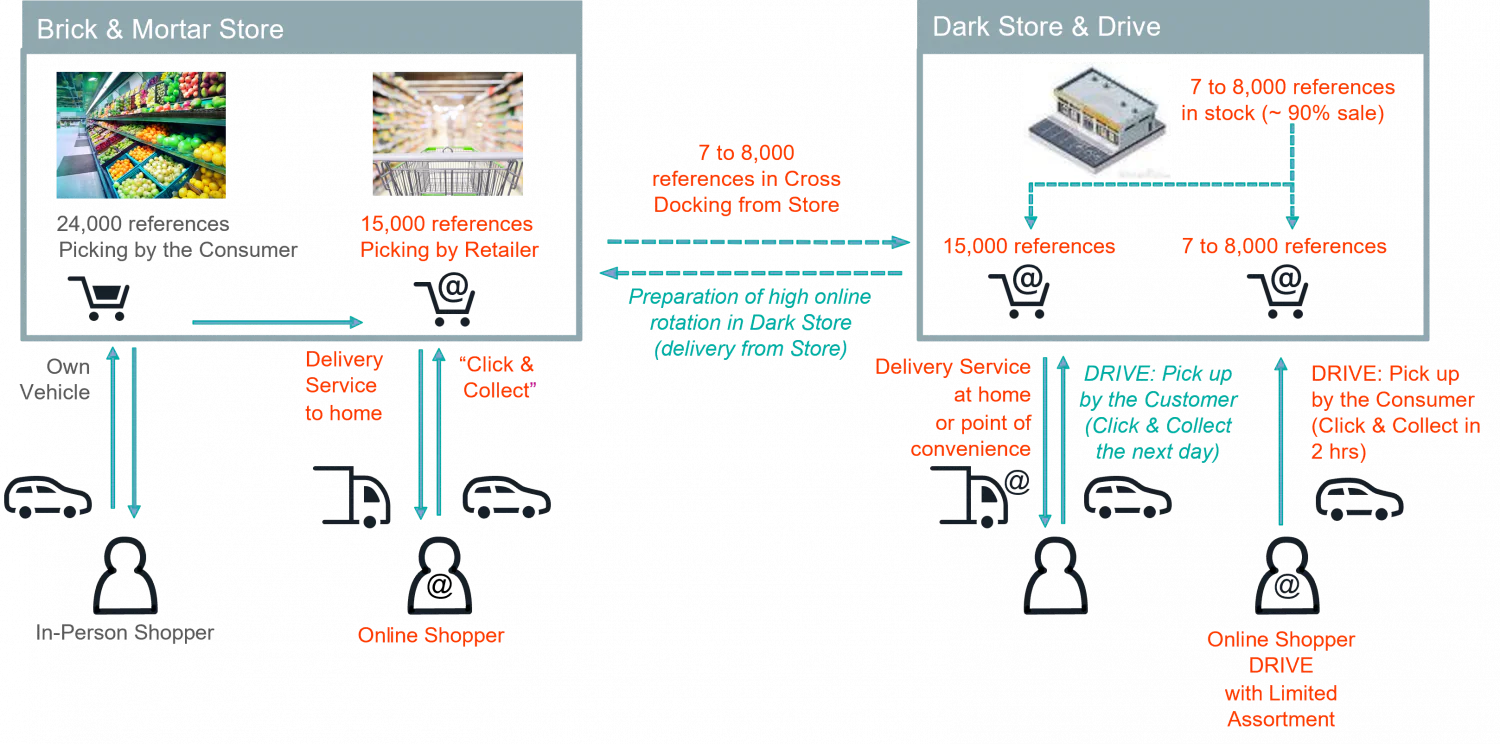

Fig. 2 Example of hybrid retail location model

A framework for project success

In a hybrid model the store front will be all about experience, while a dark backroom can be filled with automation and robotics. The best type of automation depends on each location with its specific space, height, and other restrictions.

MFC solutions offered by MHE suppliers typically consist of some sort of high-density tote storage. Picking is mostly still manual at GTP stations, eliminating only walking activities by automation. Robotics is quickly evolving though, and the capability to pick complex products, like a bundle of produce, is likely only a few years away.

For the time being, scalability of solutions is more important than the lowest remaining manual work content. Not all retailers will want to invest in a tote shuttle right away, especially not for an entire large assortment. AMR assisted manual picking of slow movers from conventional shelves can complement GTP picking of fast movers in an efficient manner.

AR glasses for user guidance and AI algorithms for optimized execution can be deployed in any physical environment, be it a dark backroom or a sales floor shared between walk-in shoppers and online fulfillment associates.

Store automation and digital fulfillment solutions could ultimately converge, making shelf displays and self check-out stations relics of the past. The shopping apps that many retailers already offer today help customers navigate through big box stores, find the products they are looking for based on real-time inventory positions on the shelves - much like the apps on the RF guns, omnipresent in warehouses.

Smart devices, like phones or wearables, can have the shopper/picker automatically identified when they enter the area, no login needed. VR will show where products are, can display prices and track products picked, all with no need to scan and keeping hands free.

Theft protection is baked right into the technology. The store doors only open known shoppers, that once in the store can take and pack right away with no need to even stop for checkout as electronic payment methods are seamlessly integrated. For 3rd party shoppers and delivery staff, integration into a driver app will ensure fulfillment time is tracked from order to delivery.

Conclusion and outlook

Many traditional retailers face problems with their business models based on brick & mortar stores while pure Ecom players struggle to be efficient on same-day delivery, and don’t have solutions for ultra-fast delivery or pick-up by the customer within hours of their online purchases.

Curbside pick-up is being offered by all major (remaining) retailers, oftentimes as a pure necessity to meet customers’ expectations and without an operational model that leverages efficiency or gains along the supply chain from manufactures to final consumers.

Automated Micro Fulfillment Centers, based on the idea that a core assortment of fast-moving products should be fulfilled out of a minimal footprint have long been seen as a magic bullet, however the initial euphoria has somewhat cooled off as retailers realize that a broader look into the value proposition is needed to attract and retain consumers. At the same time, not all commercial real estate coming available as failing retailers move out is suitable for even light ASRS installations.

Hybrid models for MFCs make best use of synergies and combine cost efficiency with shopping experiences, while also being more adaptable to building format, easier and quicker to scale, and require less upfront investment.

What scares many retailers away from the hybrid model however, is the perception that in-person shoppers would be disturbed by professional or for-hire shoppers sharing the same space.

A clear separation of zones where the focus is on trying and selecting from those where efficiency is paramount – for any kind of shopper – would be a good starting point and can certainly ease any initial transitory discomfort, much as was the case when retailers started rolling out smart displays or shelf-check outs.

Backroom automation is also still an option, fulfilling any kind of pick-up and delivery orders where displaying the merchandise is not required. And with the right mix technologies in the retail areas, any shopper will be more efficient with time freed up for better experiences than standing in line at a check-out.

The current crisis in CRE is a golden opportunity for retailers to start their journey into the future of retail. Scalable automation and digital integration are keys to success.

Author